To access the Burlington Credit Card account, the user must meet the following requirements:

- The user must have an active Burlington Credit Card.

- The user must have internet access.

- The user must have a compatible device such as a computer, laptop, tablet, or smartphone.

- The user must have a web browser installed on their device.

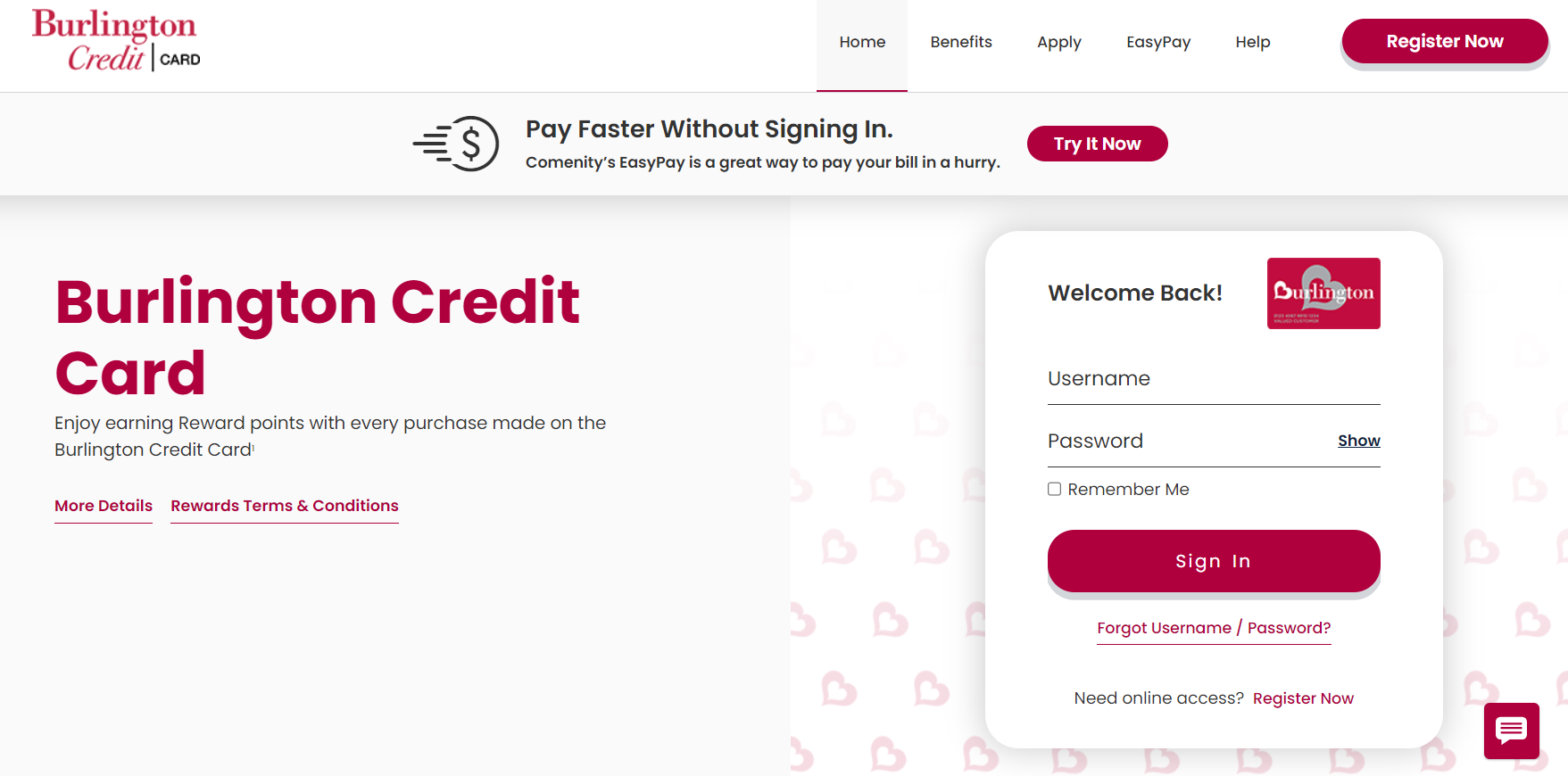

Steps to Burlington Credit Card Login

To login to the Burlington Credit Card account, the user must follow these steps:

- Open the personal online banking website of Burlington Credit Card.

- Click on the “View My Account” option on the page’s top right corner.

- Enter the user’s I.D. and password in the respective fields.

- Click on the “Sign In” button.

- Once the user is logged in, they can view their account details, check their balance, make payments, and manage their account.

It is important to note that the user must keep their login details confidential to avoid unauthorized access to their account. If the user forgets their login credentials, they can reset their password by clicking the “Forgot User ID or Password” link on the login page.

In conclusion, logging in to the Burlington Credit Card account is a simple process that requires the user to meet certain requirements and follow a few easy steps. The user can access their account details and manage their card easily by logging in.

Applying for the Burlington Credit Card Program

Eligibility Criteria

The applicant must meet certain eligibility criteria to apply for the Burlington Credit Card program. The following are the requirements to apply for the program:

- Be of legal age in your state or territory

- Have a valid, government-issued tax identification number (such as an SSN or SIN).

- Have a street, rural route, or APO/FPO mailing address (no P.O. Box addresses)

- Have a valid, government-issued photo I.D.

If the applicant meets all the above requirements, they can proceed with the application process.

Application Process

To apply for the Burlington Credit Card program, the applicant can follow these simple steps:

- Visit the Burlington website and navigate to the Credit Card section.

- Click on the “Apply Now” button to start the application process.

- Fill out the required information in the application form, including personal, contact, and financial information.

- Review the terms and conditions of the program and agree to them.

- Apply.

Once the application is submitted, the applicant will receive a response within a few days. If approved, the applicant will receive their Burlington Credit Card in the mail within 7-10 business days.

It is important to note that the applicant must have a good credit score to be eligible for the Burlington Credit Card program. The credit score will be evaluated during the application process, and if it does not meet the required criteria, the application may be denied.

Understanding Burlington Loyalty Program

Enrollment Process

To enroll in the Burlington Loyalty Program, one must be a resident of the United States, including Puerto Rico, and have a valid email address and phone number. The program is open to individuals who are 13 years of age or older. There is no fee to join or maintain membership in the program.

Visit the Burlington website and fill out the enrollment form to enroll. The form requires basic information such as name, email address, phone number, and favorite departments at Burlington. Once enrolled, members can start earning points on their purchases.

Loyalty Program Benefits

The Burlington Loyalty Program offers several benefits to its members. Here are some of the benefits:

- Earn 1 point for every $1 spent on Burlington purchases with the Burlington Credit Card

- 100 points earned on the Burlington Credit Card equals $5 in rewards

- Extended receipt-free returns window on Burlington purchases

- Early access alerts about WOW! Deals, news, and more

- Exclusive access to special events and promotions

Loyalty members can manage their accounts online by logging into their accounts. They can also use EasyPay to pay their bills quickly. Members with questions or need assistance can contact the Burlington Credit Care Center at 1-877-213-6741.

Enrolling in the Burlington Loyalty Program is a great way to earn rewards and take advantage of exclusive benefits. With no fees to join or maintain membership, it’s a win-win for shoppers who frequent Burlington.

Managing Your Burlington Credit Card Account

Managing your Burlington Credit Card account is easy and convenient. Online access allows you to pay your bill, view your statements, and manage your account from anywhere. Here are some tips to help you manage your Burlington Credit Card account.

Payment Options

Burlington offers several payment options to make it easy for you to pay your credit card bill. You can pay your bill online, by phone, or by mail. Here are the details of each payment option:

- Pay Online: You can pay online by logging in to your account on the Burlington website. You can pay your bill using your checking account or debit card. You can also set up automatic payments to ensure your monthly bill is paid on time.

- Pay by Phone: You can pay by phone by calling the customer service number on the back of your credit card. You must provide your credit card number and checking account or debit card information.

- Pay by Mail: You can mail your payment to the address on your billing statement. Be sure to include your account number on your check or money order.

Understanding Your Statement

Your Burlington Credit Card statement provides important information about your account. It shows your current balance, available credit, and minimum payment. It also includes a summary of your recent transactions and any fees or interest charges applied to your account.

Here are some tips to help you understand your Burlington Credit Card statement:

- Minimum Payment: Your minimum payment is the amount you must pay by the due date to avoid late fees and penalties. It is usually a percentage of your current balance.

- Options to Pay: Your statement will provide information on the payment options available online, by phone, or by mail.

- Payment Address: Your statement will also include the address to mail your payment.

Understanding your statement and payment options allows you to effectively manage your Burlington Credit Card account and avoid late fees and penalties.

Burlington Credit Card Rewards and Benefits

Burlington Credit Card offers a range of rewards and benefits to its cardholders. In this section, we’ll discuss the different rewards and benefits of the Burlington Credit Card.

Earning Rewards

Burlington Credit Card members can earn points for every dollar they spend on Burlington purchases. Cardholders earn one point for every dollar spent. Members can redeem these points for rewards certificates that can be used on future Burlington purchases. The following table shows the reward points and their corresponding value:

| Points | Value |

|---|---|

| 100 | $5 |

| 500 | $25 |

| 1000 | $50 |

| 2000 | $100 |

Redeeming Rewards

Cardholders can redeem their rewards certificates in-store or online. They can use them to purchase any item at Burlington. The certificates cannot be used to pay for gift cards or applied to previous purchases. The reward certificates expire after 90 days.

New cardholders can enjoy a special discount when signing up for a Burlington Credit Card. They can receive 10% off their first purchase made with the card. Cardholders can also take advantage of exclusive discounts and offers throughout the year.

In addition to the rewards program, Burlington Credit Card members can benefit from free standard shipping on orders over $50, early access to sales, and special financing options on large purchases.

Overall, the Burlington Credit Card rewards and benefits program offers cardholders a range of perks that can help them save money on their purchases and enjoy exclusive discounts and offers.

Key Information about Burlington Credit Card

Burlington Credit Card is a great way to earn rewards while shopping at Burlington. The card offers several benefits, including earning points for every dollar spent and extended receipt-free returns. However, before applying for a card, it is essential to understand the fees, APR, and credit card agreement.

Understanding Fees and APR

Burlington Credit Card has an APR of 26.99%, a variable rate. The APR may vary based on the prime rate. Late and returned payments may result in a penalty APR of up to 29.99%. The card has no annual fee, but there are fees for late payments, returned payments, and cash advances. The late payment fee is up to $40, and the returned payment fee is up to $29. The cash advance fee is either $10 or 4% of the amount of each cash advance, whichever is greater.

Credit Card Agreement

Burlington Credit Card has a credit card agreement that outlines the terms and conditions of the card. The agreement covers APR, fees, payment allocation, and credit limit. Reading and understanding the agreement before applying for the card is essential. The agreement can be found on the Burlington Credit Care Center website.

In summary, Burlington Credit Card offers several benefits, including earning rewards for every dollar spent and extended receipt-free returns. However, it is crucial to understand the fees, APR, and credit card agreement before applying for the card. By doing so, customers can make an informed decision about whether the card is right for them.

Also Read: UPSers Employee Login

Contact Information for Burlington Credit Card

Mailing Address

Customers who need to contact Burlington Credit Card through mail can use the following address:

Burlington Credit Card

PO Box 182273

Columbus, OH 43218-2273

Physical Address

For those who prefer to visit Burlington Credit Card in person, the physical address is:

Burlington Credit Card

c/o Comenity Capital Bank

P.O. Box 183003

Columbus, OH 43218-3003

It’s important to note that this address is for mail correspondence only. Customers cannot visit this location in person.

If you have any questions or concerns about your Burlington Credit Card account, contact customer service at (877) 213-6741. The customer service department is available Monday through Saturday from 8 AM to 9 PM EST. TDD/TTY users can call 1-888-819-1918.

Alternatively, you can reach out to Burlington Credit Card through email. Visit the Burlington website and click on the “Contact Us” link at the bottom of the page. From there, you can fill out a contact form with your name, email address, and message. A customer service representative will respond to your inquiry as soon as possible.

Overall, Burlington Credit Card provides several options for customers to get in touch, whether through mail, phone, or email.